The CAPM has proved to be very useful to the financial analysts as well as the investors for determining the returns possible from various investments.

Returns Subject to Normal Distribution Function: The returns which the investors can avail on the complete portfolio is subjected to the normal distribution function.ĭiversified Investors: It is assumed that all the investors aim at diversifying their portfolio into different kinds of securities with different risk and return involved.įixed Amount of Assets: CAPM assumes that the quantity of the available assets remains the same throughout the given period.Īssets are Divisible: All holdings in the portfolio are easily bought and sold in the open market and are divisible into small units.īeta Coefficient is the Only Measure of Risk: The level of systematic risk of the securities is measured strictly in terms of Beta. The financial institutions also provide unlimited funds to investors.Įqual Access to Info: Another assumption is that the investors have the complete knowledge of the market and the securities they invest in. Investors can Borrow/Lend Unlimited Amounts: The investors can avail limitless borrowings lying under the risk-free rate. Markets are in Equilibrium: It is presumed that the investors never influence the value of the securities instead, they only take the investments at a price available in the market. At the same time, they aim to make the maximum utility of their investments. they try to stay away from risky securities. Rational Investors: The investors are assumed to be rational, i.e. Moreover, there is no short-selling restrictions or inflation. Markets are Ideal: The next assumption is that there is no transaction fees and taxes charged from investors. Homogeneous Expectations: The CAPM assumes that the expectations of the investors remain the same throughout the given period. The concept of capital asset pricing model works on certain assumptions. These formulae of expected return on investments are derived from the above formulae.Īssumptions for Capital Asset Pricing Model (CAPM) If the risk-free rate of return is 3%, and the expected market return is 11.5%, find out the expected return on each security. Beta A is 0.45 similarly, Beta B is 1, and Beta C is 1.35.

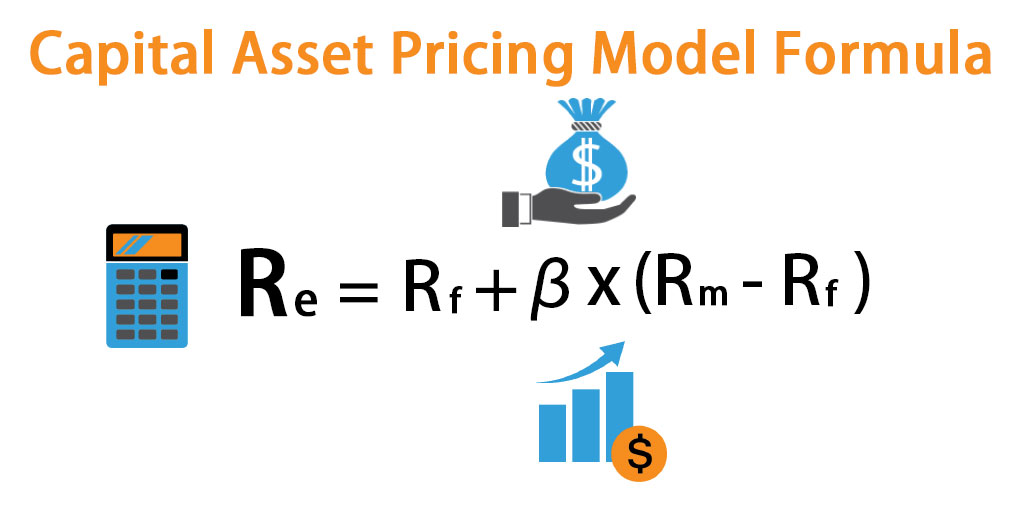

Question: Considering the above graph, let us assume that systematic risk involved in ‘A,’ i.e. The risk premium of a particular investment which is the excess of returns from that specific security over the risk-free rate is calculated as below: Market risk premium determines the excess return over the risk-free rate of the whole market. Graphical Representation of the Security Market Line Here, the systematic risk is related to the marketable securities is denoted as ‘beta’ and depicted on the x-axis, whereas expected return is represented on the y-axis. The security market line is the graphical representation plotting the relationship between systematic risk and returns on a portfolio. It is the means of preparing a combination which provides the highest possible returns on a minimum level of risk. The capital market line is a theoretical concept which outlines the efficient portfolios by interpreting the risk-return trade-off. To determine the returns on investment and the return on securities portfolio with the help of systematic risk involved in it, the capital asset pricing model provides the following two ways: Content: Capital Asset Pricing Model (CAPM) Whenever an investment portfolio is created, the capital asset pricing model helps to asses the risk and estimate the possible returns from the investments made.

0 kommentar(er)

0 kommentar(er)